By Conrad Mwanawashe

The energy sector registered the highest projected investment value of US$2,8 billion at licensing, with six new licenses being issued, spurring the quarter to September to a 12,5% rise over the second quarter in the number of investor licences issued, the Zimbabwe Investment Development Agency (ZIDA) CEO Tafadzwa Chinamo has said.

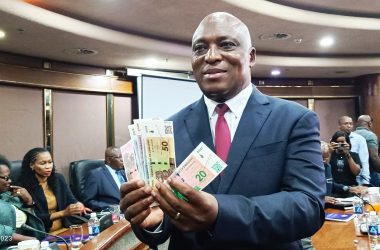

Presenting the Q3 report, Tuesday, Chinamo said the quarter was an “exciting and fruitful period for ZIDA” as the Agency continued to attract and facilitate investments that drive economic growth and development.

“Regardless of the challenges faced, we registered encouraging investor interest across most sectors during the quarter. If the two big solar projects pan out, it would be great for the country as we’re currently experiencing some serious energy deficit,” Chinamo said.

In Q3, 82% of projected investment value for all new licence approvals were issued in the energy sector.

“The largest projected investment was by New Eagle Industrial Park (Pvt) Ltd which intends to invest US$2,3 billion towards the development of an energy industrial park in Mapinga. This was followed by Sunone (Pvt) Ltd with US$496.8 million towards the development and operation of a 500MW solar power plants in Mazowe, Manhize and Mutoko,” said Chinamo.

Licensing is one of the Agency’s key functions which allows for the establishment of a binding relationship with investors. Licenced investors are also expected to implement their projects as licenced and follow ups are done to ensure compliance as licenced through monitoring and evaluation of the projects by the Agency.

The Agency record activities at all the licencing stages. At the new licence application stage, the Agency records the value of the investment to be established as well as its form, for instance, equity, loan or capital equipment, local funds and local assets. Other details recorded include sector, intended location, province, country of origin of the investor and impact on the local economy through employment creation, for example.

At the renewal stage, the Agency records actual investment made by the investor against what they anticipated investing on initial licencing. The Agency establishes the actual amount invested as verified against acceptable proof of investment such as bills of entry, bank statements, ZIMRA declaration forms, among others.

During the year to September, the Agency managed to draw investors from 38 countries compared to 27 in 2022. During both periods, investors from China were the most by number and investment value with mining being their most preferred sector followed by the manufacturing sector.

ZIDA participated in the 21st Edition if the Africa Down Under (ADU) Conference held in Perth, Australia from 6-8 September.

The ADU is the leading forum for Australian – African businesses and governments and was first launched to raise awareness of Australia’s interests in African mining and energy sectors.

ZIDA is expecting to close huge investment projects in Q4.

“We’re closing one of the biggest tie ups. Our visit to Australia was fruitful and we’re hoping to close this before the end of the year,” said Chinamo.